(Cross-posted from the Mediafly Blog)

When I used to envision how small companies create a great strategy, I would often imagine a single or multiple leaders sitting down and writing out something to the effect of “here are the three things that we’ll do to win.” The picture in my mind is complete with a boardroom or conference room, men and women wearing business suits, and hours of PowerPoint presentations at the ready. My experiences at a management consulting firm reinforced this: oftentimes, decisions started as hypotheses by the most senior leaders, and were then justified back to them by consultants who gathered and made sense of data.

After growing Mediafly by 657% over the past three years (and that’s not even including 2014 or 2015 numbers), I’ve come to shift my mental picture of how strategy is built at small companies. The big conference room is replaced by a small one, often with people on the other end of GoToMeeting; suits are replaced by jeans; PowerPoint is replaced by conversation with a few bits of data thrown in; and the confidence of “here are the three things that we’ll do to win” is replace by “here are what we think might be good to try, based on a little bit of data, a lot of intuition, and a willingness to adjust as we learn.”

But the biggest surprise in my mental picture comes from how we develop strategy. Our strategy is highly influenced and often derived by our incredibly empowering culture and system of ad-hoc conversations.

What makes our culture empowering?

At Mediafly, engineering, customer success, marketing, sales, and even interns have open, candid conversations with the executive team every day, passing along ideas and feedback in both directions. Customers can pick up the phone or write an email to anyone on the team, and expect to get help to solve issues. If team members find something they don’t like about any system, they are empowered to proactively fix it. Many team members work across divisional lines (engineering and marketing; sales and product; marketing and customer success), which empowers those team members to fix and grow even more.

What are ad-hoc conversations at Mediafly?

As a result of the culture, our team members find themselves in ad-hoc conversations about all parts of the business every day. Conversations will form at each others’ desks, over lunch or drinks, on our messaging systems (GChat, HipChat), and of course by email. These all serve to align how each of us thinks about our company’s place in the world. All of this coalesces and informs our company’s strategy.

A couple of great examples of what I mean:

Example 1:

Our strategy focuses on “content mobility”. Previously, this meant mobile (and primarily iOS) apps. However, several inputs came together to help us broaden and redefine this this past year:

- Sales: We had several sales meetings in which it became clear that many companies simply won’t ever buy iPads for their sales staff

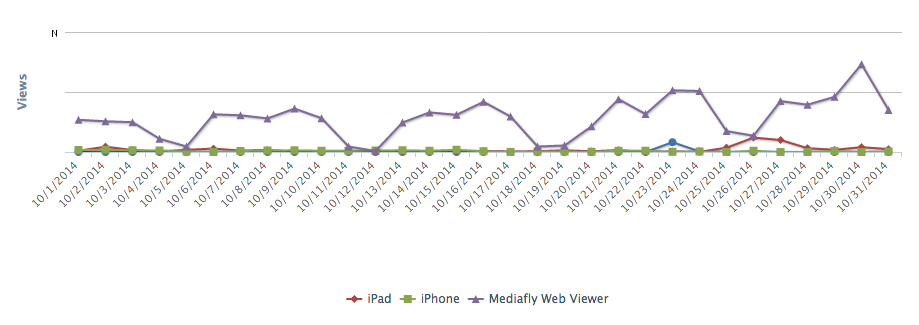

- Product: After analyzing our usage data, we realized that the primary platform for using Mediafly is through our Web Viewer on a desktop browser (not a mobile device and not one of our apps)

- Customer Success: A few conversations with existing customers crystalized that a desktop app would go a really long way to embracing Mediafly

- Market: Windows Surface and touchscreen Windows 8 hybrid tablets are starting to gain traction

These inputs came in through our empowered team members thinking about their areas, via conversations at each others’ desks and at meals.

Assimilating these inputs was easy, when there were so many of them pointing in the same direction. As a result, we’ve begun to work on a desktop application and plan to release it within the next several months (stay tuned!).

Example 2:

We originally developed our Interactives Platform back in Q2 2012. At the time, we assumed Mediafly would build a consulting arm that caters to creating Interactives via consulting services to our enterprise customers, while our core team focuses on enterprise software licensing. We operated under this approach for almost a year, netting a reasonable amount of consulting work.

However, again, several inputs from our empowered team members, gathered via many conversations, helped reshape how we think about this:

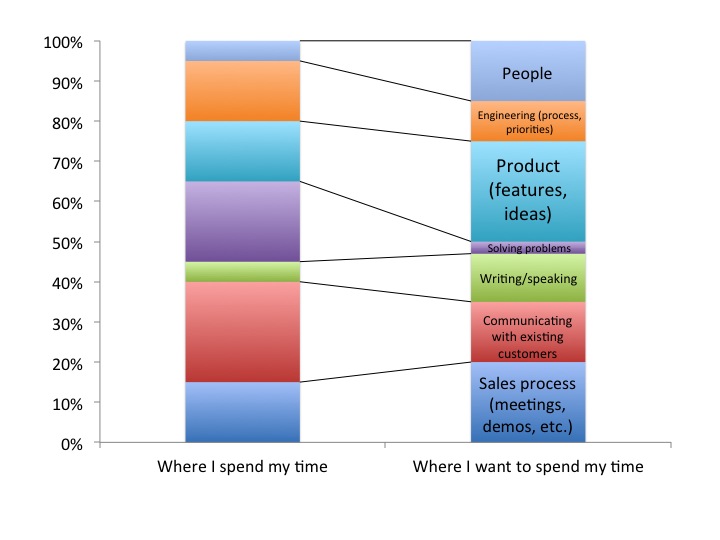

- Engineering and Product: Every time Engineering was pulled into an Interactive engagement during this time period, we had to delay work on the product side for a custom piece of work. However, the product side is where the bulk of our “enterprise value” would eventually come from.

- Team: Getting sucked into consulting engagements of this form was extremely hard, and team members were working way longer than normal. This was largely because we weren’t used to the multiple back-and-forth design rounds required for consulting to overlap with product work, and time was tight.

- Industry: we started to meet some great agencies and software development firms, and believed they could be incredible partners.

We made the decision in 2013 to terminate all new Interactives development for our customers (with a few exceptions). The result has been amazing: better products, better focus, happier customers, and partners who are doing amazing work.

As we continue to serve more customers with our phenomenal products and services, we will strive to:

- Ensure team members continue to feel empowered to bring up ideas and issues,

- Keep lowering friction for ad-hoc conversations to take place, and

- Drive company strategy based on the output of our culture, as much as it is based on other external factors